The Devasting Mistake in Real Estate Investing that *Happens All the Time* – and How to Avoid It

- 4 days ago

- 6 min read

Updated: 2 days ago

Real estate's long-term track record is excellent — comparable to stocks in raw returns and superior on an after-tax basis. So why do I see so many real-estate investors end up with massive irrecoverable losses in their portfolios -- and leading them to incorrectly conclude that “real estate investing doesn’t work”? This article examines the unintuitive and devastating mathematics of large losses. And it shares how to mitigate that crucially important, but under-appreciated, risk.

(Usual disclaimer: I'm just an investor expressing my personal opinion and am not an attorney, accountant nor your financial advisor. Consult your own financial professionals before making any investment or tax related decisions. The information here could be wrong, so use at your own risk. Code of Ethics: To remove conflicts of interest that are rife on other sites, I/we do not accept ANY money from outside sponsors or platforms for ANYTHING. This includes but is not limited to: no money for postings, nor reviews, nor advertising, nor affiliate leads etc. Nor do I/we negotiate special terms for ourselves in the club above what we negotiate for the benefit of members. Info may contains errors so use at your own risk. See Code of Ethics for more info.)

Real estate’s long-term returns have been as strong as stocks (and with less volatility). And its after-tax performance has trounced public equities — for investors who understand how to use its unique tax advantages.

Yet despite these strengths, I repeatedly see real-estate investors making one common fatal mistake with their real estate portfolios (and based on that mistake, concluding that “real-estate investing itself must not work”).

During the upcycle, they chase aggressive deals with high projected returns. And everything works great for years ... while prices are rising. But when the cycle inevitably turns, those same deals are the first to collapse — and investors take large losses.

And because the unintuitive math of large losses is so brutal, they never realistically recover — even over the entire next upcycle.

And what could have been a temporary speed-bump becomes a permanent hole in their portfolio.

So this article is about avoiding that outcome. And it’s presented in two parts.

This Part 1 shows how real estate has performed versus stocks, why large losses are so mathematically devastating, and strategies for mitigating that risk.

Part 2 walks through a real-world example of an egregiously aggressive deal that imploded — from YieldStreet (which has since rebranded to Willow Wealth). It also explains the warning signs that were visible from day one.

The co-champion hidden in plain sight

Many investors assume that stocks — through ETFs, index funds, etc.— are the undisputed champions of long-term investing.

But that assumption isn’t supported by the data.

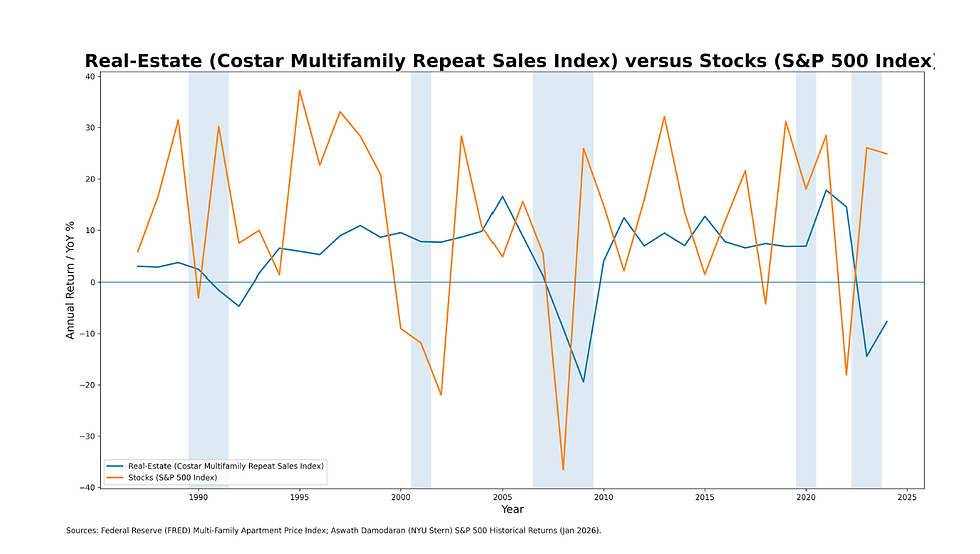

And there’s actually another champion hiding in plain sight: real estate. Over long periods, real-estate’s produced raw returns comparable to stocks (but with less volatility):

From the study The Rate of Return of Everything, summarized here: And the differences don’t stop there. For investors who understand how to use depreciation and other tax advantages, real-estate trounces public equities … and produces after-tax outcomes that stocks simply can’t match.

That’s why real estate is an integral part of my portfolio (along with stocks, non-real-estate alternative investments and U.S. treasuries).

How to steal defeat from the jaw of victory

Yet despite real-estate’s strong long-term record, I repeatedly see many investors shooting themselves in the foot and making the same mistakes with it.

And ironically, one of real-estate’s strengths (long periods of low volatility…often lasting years) lulls them into making a fatal mistake. During real estate’s long, stable expansion cycles, they chase the deals with the highest projected returns. And everything's grand for many years … because valuations are rising and credit is abundant. But when the cycle turns — as it always does — those same high-octane strategies are the first to break. And investors get hammered. And despite all of real estate’s benefits, many never fully recover. Why?

The Un-intuitive and Devasting Math of Large Losses

The math on large losses is surprisingly unforgiving.

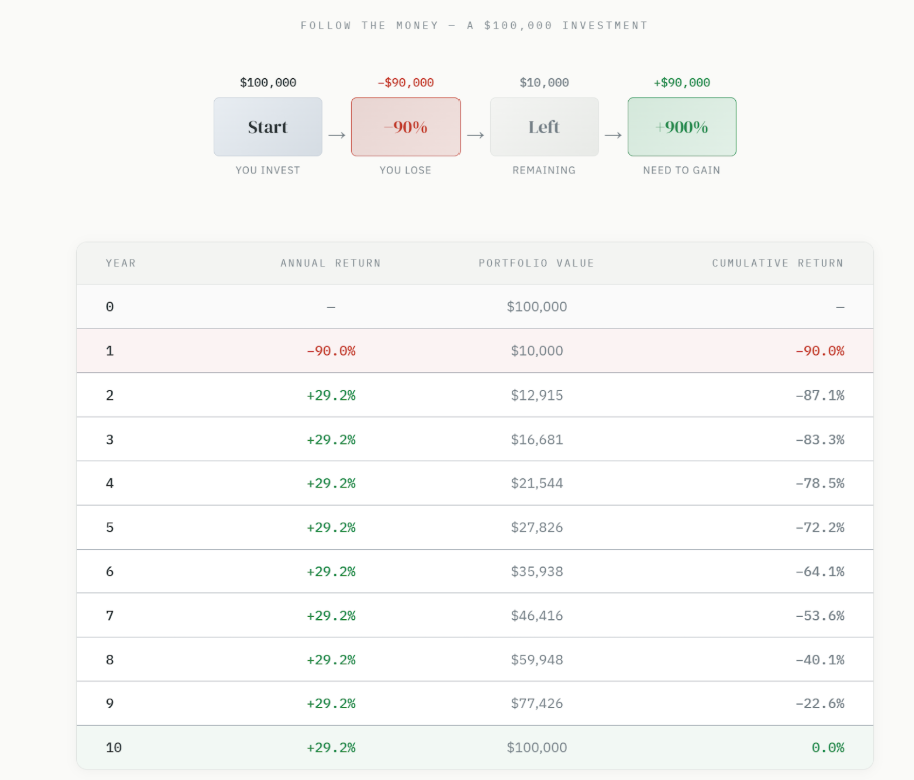

An investor who loses 90% on an investment needs to earn a whopping 900% on future investments just to break even.

Source: Real Estate CrowdFunding Review.

That's seems exponentially worse than most people intuit that it should be. But the math is clear:

The single large loss becomes a massive hole to dig out of. So even if that investor later earns an improbably high 29% for the next 9 years of the upcycle... they’re merely back to square one.

So realistically, a single large loss easily wipes out all the gains of the next upcycle.

And that’s true even in real estate where the upcycles are much more stable than the stock market and often run many years longer (i.e. volatility is lower):

Containing losses

On the other hand, a contained loss of 10% requires only an 11% gain to recover. That’s manageable. And in a long-term investment plan, it becomes little more than a temporary hiccup (in the longer road to success).

Even better is avoiding losses altogether by simply earning less than originally projected. In a downcycle, preserving capital is often the best possible outcome. Either way: Investors who protect principal during contractions are positioned to compound more efficiently in the next expansion.

Sponsors who focus on minimizing large losses

So that’s why my number one criteria in a sponsor is to see multiple real-estate cycles of experience and a track record of little to no money lost. Why take a risk on a green sponsor that hasn’t learned the ropes yet (especially when the damage of getting it wrong is so severe)?

This means I pass on many attractive-looking deals with high projected returns. And during the upcycle, this discipline can feel difficult (and while more-aggressive investors are bragging about their large returns). However, when the downcycle inevitably comes, the math on avoiding large losses makes all the difference in the world.

However...finding sponsors like this is hard. First, there aren't many (as most others find it easier to market flashier-looking deals to aggressive investors). And they generally don't market / advertise on crowdfunding sites or social media (as most have built up strong followings over the years and generally don't need to).

So I created the Private Investor Club to address this problem. Together with thousands of other investors, we source new sponsors, and share our due diligence.

And here are some sponsors in that rare category of having multiple cycle experience and have never taken a large loss (i.e. their investors have realized either little or no losses).

More ways to mitigate big-loss risk

I also avoid concentrating my investments into any one single vintage year (because that can also cause massive losses). Instead I spread my investments across many vintage years — similar in concept to dollar-cost averaging in public markets — to reduce the impact of any a downturn.

In the deals themselves, I also require/want to see:

Conservative use of debt (65% loan-to-value maximum) to mitigate the risk of a disastrous default.

Long term loans (7-10 years) to reduce the risk of the investment blowing up due to the loan coming due at the wrong time.

Fixed-rate loans , to prevent interest-rate increases from crashing the investment.

High skin-in-the-game and reasonable promote, to mitigate the fact that the promote financially incentivizes a sponsor to push the risk-envelope...and which is the opposite of avoiding big losses.

And so far, I’ve been very happy with how my selections have fared in the current CRE downturn (which began in 2022). I currently have zero realized losses -- and things look likely to stay that way. So I plan to hold onto this strategy.

In contrast, I know of many investors who were very aggressive up to 2022. And when the downcycle hit, they were hit hard (and will never realistically recover). And it's not that real estate investing itself "doesn’t work". They were lulled into complacency by the low volatility and lengthy up-cycle and which can be a double-edged sword. It's one of real-estate strengths but can also can effectively become a psychological trap. And they also didn't appreciate the unintuitive math of large losses and how important it is to avoid that risk.

Next up: Part Two--"What not to do"

In Part Two of this article we will look at an aggressively underwritten deal from YieldStreet (now rebranded to Willow Wealth) that completely imploded and lost 100%. And we will look in detail at the many red flags and warning signs that were evident from day one. 2/18/2026....Part Two is being worked on and will be published in the next few weeks.

Learning and Discussing More...

Private Investor Club members have been discussing experienced sponsors with little-no-losses for years. And it's accumulated detailed due-diligence, real-life investor reviews, and more on them and hundreds of other sponsors and deals.

If you're already a member, click here to discuss further:

If you're not yet a member, then joining is free.

To protect all members and keep the conversations useful and confidential, all applicants are required to verify that they're solely investors (and not investment sponsors, platforms or their affiliates)

Click here to learn more or to join.