PeerStreet Declares Bankruptcy

- Jul 16, 2023

- 4 min read

The once immensely popular platform suffered devastating declines in investor approval over the years. And despite previous reassurances, investors are now exposed to bankruptcy-related losses on $205 million of outstanding loans (with more than 50% non-performing).

(Usual disclaimer: I'm just an investor expressing my personal opinion and am not an attorney, accountant nor your financial advisor. Consult your own financial professionals before making any financial decisions. Code of Ethics: To remove conflicts of interest that are rife on other sites, I/we do not accept ANY money from outside sponsors or platforms for ANYTHING. This includes but is not limited to: no money for postings, nor reviews, nor advertising, nor affiliate leads etc. Nor do I/we negotiate special terms for ourselves in the club above what we negotiate for the benefit of members. Info may contains errors so use at your own risk. See Code of Ethics for more info.)

Peer Street declared bankruptcy on June 26, 2023. They filed for Chapter 11 and are attempting to sell their loan portfolio and other assets to pay off their creditors.

Many years ago (back when the RECFR first started), Peerstreet came on the scene with a huge bang and quickly became one of the most popular platforms with investors.

But over the years, things changed and investors soured on them. They alleged Peerstreet had too many defaulted notes, unacceptably poor underwriting/valuations, and poor communication when things went wrong. As a result, this site downgraded PeerStreet to “on probation” in 2020. Then in the 2023 ranking, only 7.1% of investors gave the company a positive review (with 85.7% saying they "do not recommend" and 7.2% undecided). So the RECFR gave PeerStreet the lowest possible rating for an operating site: a 1 out of 10 (“challenged due to investor alleged complaints”).

Will investors get their money back?

Readers of the RECFR knew that one of the potential risks of the platform was that the investors didn't directly own the notes (i.e. the investment was not directly secured by the note). This means that in a bankruptcy, some or all of the money could be lost (if owed to creditors). Even in the best case scenario, where money might ultimately be returned, it gets tied up in limbo, potentially for a long time.

When this was mentioned to PeerStreet, they claimed to the RECFR that the risk was mitigated by this:

"PeerStreet holds loans in a bankruptcy-remote entity that is separate from our primary corporate entity. In the event PeerStreet no longer remains in business, a third-party “special member” (CT Corporation) will step in to serve as a trustee to manage loan investments and ensure that investors continue to receive interest and principal payments." -PeerStreet.com

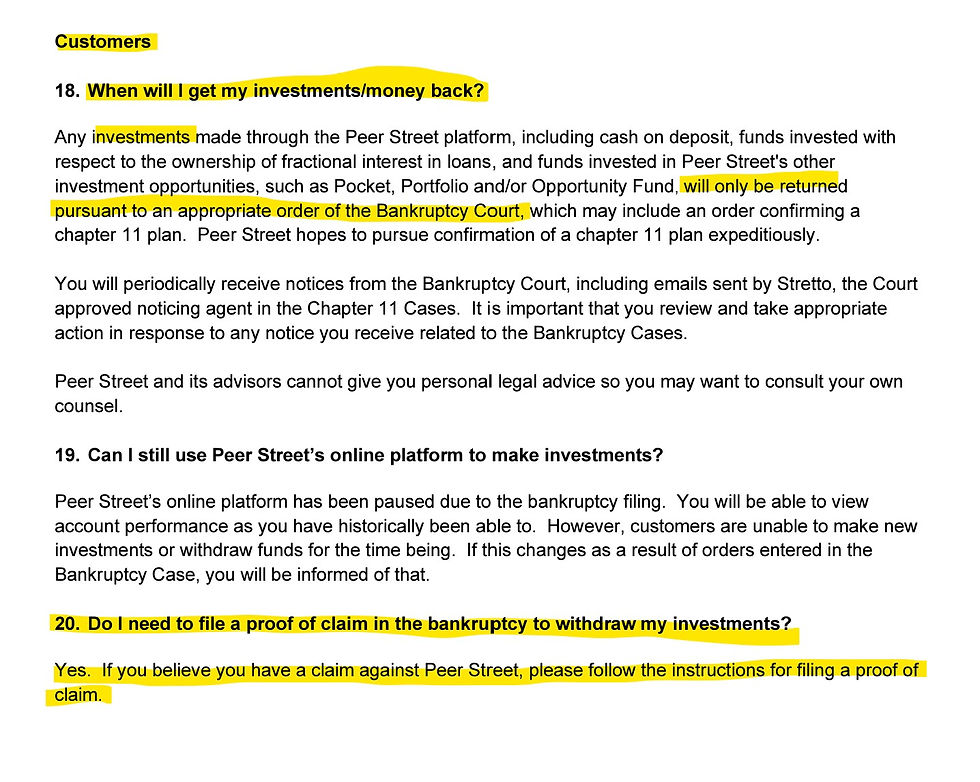

However, now that bankruptcy is here, Stretto (the legal firm appointed by the court) has created an FAQ that says that investor money will be sucked into the bankruptcy proceedings:

In such proceedings, investor money is at risk.

So PeerStreet's prior claims of investors continuing to receive interest and principal back (and not having money at risk in the bankruptcy) appear to be inaccurate.

Additionally, the Private Placement Memorandum (PPM) for the PeerStreet notes discloses this:

Your Rights If PS Issuer or Any Other PSI Affiliate Dissolve Are Uncertain

* The Real Estate Securities are unsecured, and you do not have a security interest in the Underlying Investments. Accordingly, you may be treated the same as other general creditors of ours and thus be required to share the proceeds of Underlying Investments with those creditors. * Because the Real Estate Securities only entitle Investors to receive payments or distributions tied to one or more Underlying Investments, you might not be entitled to share in the other assets of PeerStreet available for distribution to general creditors, even though other general creditors might be entitled to a share of the proceeds of such Underlying Investments.

This appears to further confirm that investors are now exposed to bankruptcy-related losses.

How much is at risk?

According to the Chapter 11 filing, investors were invested in $205 million outstanding unsecured loans on the platform.

And the filing also reveals that a mind-boggling amount of these loans were non-performing (meaning the borrower stopped paying). This came to about $112 million out of the $205 million and about 54%.

Non-performance causes the value of a note to plummet. So, should PeerStreet be allowed (and able) to sell them, there's virtually no chance of all investors getting all their original money back (let alone getting the interest, which was the reason for investing in the first place).

Additionally, the Chapter 11 filing reveals more about another PeerStreet investor product: Pocket Loans (which were unsecured redeemable warehouse notes). On January 31, 2023, PeerStreet halted redemptions on these via a “liquidation trigger” (likely caused by having more liquidation requests than they could satisfy). As of the filing, approximately $41.4 million of these were outstanding.

What happened?

The filing also says that PeerStreet revenue had cratered in 2022, and was down 23.2% from the previous year (at $37.4 million). It also discloses that it was unable to raise additional money to keep going via the venture capital market. In years past, PeerStreet had been very successful at VC fundraising. Along with the above, PeerStreet gave several other reasons for their downfall in the filing. But in these claims, they made no mention of the massive percentage of bad loans or the overwhelming customer dissatisfaction.

What do I need to do?

The Stretto FAQ says that any investor hoping to withdraw their money needs to file a claim (see screenshot above). The FAQ doesn’t give a link to do this, but presumably that’s done here: https://cases.stretto.com/peerstreet/file-a-claim/